The Ultimate Guide To Palau Chamber Of Commerce

Wiki Article

Some Known Details About Palau Chamber Of Commerce

Table of ContentsPalau Chamber Of Commerce for BeginnersPalau Chamber Of Commerce Fundamentals ExplainedSome Of Palau Chamber Of CommerceAbout Palau Chamber Of CommercePalau Chamber Of Commerce Can Be Fun For Anyone5 Easy Facts About Palau Chamber Of Commerce ShownThe Buzz on Palau Chamber Of Commerce4 Simple Techniques For Palau Chamber Of Commerce

As a result, nonprofit crowdfunding is getting the eyeballs these days. It can be made use of for details programs within the company or a basic donation to the cause.Throughout this action, you may want to believe regarding milestones that will certainly suggest an opportunity to scale your not-for-profit. When you have actually run for a bit, it's vital to take some time to believe about concrete development goals.

Palau Chamber Of Commerce - Truths

Without them, it will be difficult to assess as well as track progression in the future as you will have absolutely nothing to measure your results against and you will not know what 'successful' is to your not-for-profit. Resources on Beginning a Nonprofit in numerous states in the United States: Beginning a Not-for-profit FAQs 1. Exactly how a lot does it cost to start a nonprofit company? You can begin a nonprofit organization with a financial investment of $750 at a bare minimum and also it can go as high as $2000.

Palau Chamber Of Commerce Can Be Fun For Everyone

Although with the 1023-EZ kind, the processing time is typically 2-3 weeks. 4. Can you be an LLC as well as a not-for-profit? LLC can exist as a nonprofit limited responsibility company, nevertheless, it needs to be completely had by a solitary tax-exempt not-for-profit company. Thee LLC ought to likewise satisfy the needs based on the IRS mandate for Limited Obligation Firms as Exempt Company Update.What is the difference in between a foundation and a not-for-profit? Structures are commonly moneyed by a household or a corporate entity, yet nonprofits are moneyed via their incomes and fundraising. Structures generally take the cash they started with, invest it, and afterwards distribute the cash made from those financial investments.

The Only Guide to Palau Chamber Of Commerce

Whereas, the extra cash a not-for-profit makes are made use of as operating prices to money the organization's goal. Nevertheless, this isn't always true in the case of a structure - Palau Chamber of Commerce. 6. Is it hard to start a not-for-profit organization? A not-for-profit is a company, however starting it can be fairly intense, requiring time, clearness, and cash.There are several steps to start a not-for-profit, the obstacles to access are fairly couple of. Do nonprofits pay tax obligations? If your not-for-profit gains any kind of revenue from unassociated tasks, it will owe earnings taxes on that amount.

The Definitive Guide to Palau Chamber Of Commerce

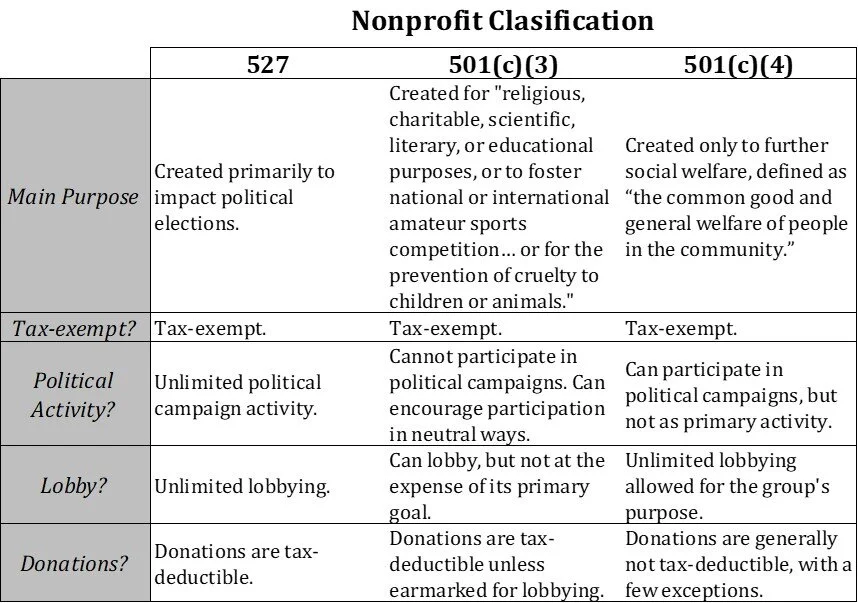

Twenty-eight various kinds of not-for-profit organizations are recognized by the tax legislation. By much the most common type of nonprofits are Section 501(c)( 3) companies; (Section 501(c)( 3) is the component of the tax code that accredits such nonprofits). These are nonprofits whose mission is philanthropic, religious, educational, or clinical. Section 501(c)( 3) company have one huge advantage over all other nonprofits: payments made to them are tax deductible by the donor.

Some Known Details About Palau Chamber Of Commerce

The lower line is that personal foundations get a lot even worse tax treatment than public charities. The major distinction between private foundations as well as public charities is where they obtain their economic assistance. An exclusive foundation is commonly controlled by a specific, family members, or company, as well as gets many of its revenue from a few donors and financial investments-- an example is the Costs as well as Melinda Gates Structure.

The Of Palau Chamber Of Commerce

This is why the tax regulation is so tough on them. Most structures just provide money to various other nonprofits. Nonetheless, somecalled "running foundations"operate their very own programs. As a functional matter, you require at the very least $1 million to start a personal foundation; or else, it's not worth the problem and cost. It's not surprising, then, that a personal structure has been explained as a huge body of cash surrounded by people who desire several of it.Other nonprofits are not so lucky. The internal revenue service at first assumes that they are personal structures. However, a brand-new 501(c)( 3) organization will be classified as a public charity (not a private structure) when it obtains tax-exempt status if it can show that it reasonably can be anticipated to be openly supported.

6 Easy Facts About Palau Chamber Of Commerce Described

If the internal revenue service classifies the not-for-profit as a public charity, it keeps this status for its initial 5 years, regardless of the public support it click here for info actually obtains throughout this time. Palau Chamber of Commerce. Starting with the nonprofit's sixth tax year, it must reveal that it satisfies the public assistance examination, which is based on the assistance it gets during the existing year as well as previous four years.If a not-for-profit passes the test, the internal revenue service will proceed to check its public charity status after the initial five years by calling for that a completed Set up A be filed each year. Palau Chamber of Commerce. Figure out more concerning your nonprofit's their website tax obligation status with Nolo's publication, Every Nonprofit's Tax Overview.

Report this wiki page